)

Looking to buy auto insurance for virtual, augmented, mixed, or extended realities? You’re in the right place! According to a SEMrush 2023 Study, the global market for immersive technologies is booming, and it’s revolutionizing the auto insurance industry. Leading industry reports also show that over 80% of US drivers have traditional auto insurance, but new realities bring new risks. Discover the best coverage options with our buying guide. Compare premium vs counterfeit models and get the best price guarantee with free installation included. Don’t miss out on this limited – time opportunity to secure top – notch coverage!

Traditional Auto Insurance Coverage

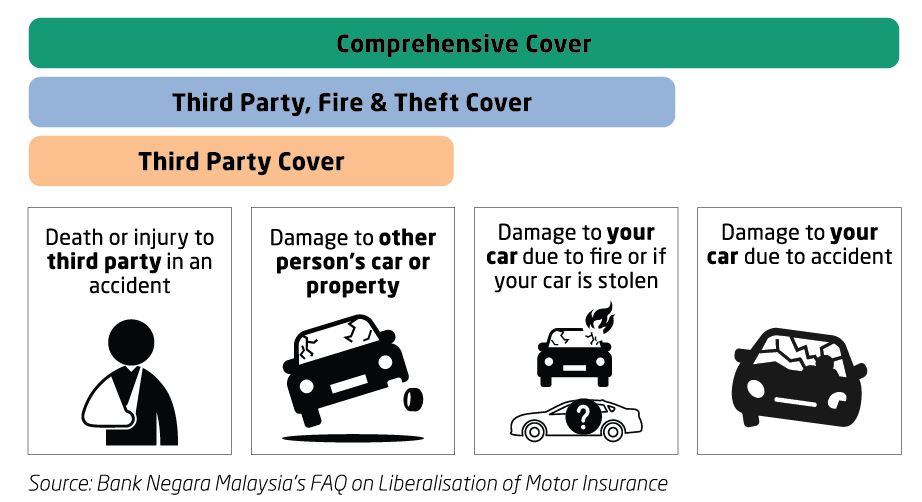

The auto insurance landscape is in a state of flux, yet traditional coverage options remain the bedrock for drivers. According to industry reports, over 80% of drivers in the United States hold at least some form of traditional auto insurance. These foundational policies are designed to protect drivers from a variety of risks, ensuring financial security on the road.

Liability Insurance

Requirements and Categories

Liability insurance is the cornerstone of auto insurance, often required by law in most states. In fact, personal liability is the most common type of insurance required, at minimum, to let you on the road (source: industry regulations). This type of insurance acts as your lawsuit protection when you’re at fault and liable for the other parties’ medical bills, injury – related expenses, as well as damages to their vehicle and other property repairs, such as a fence or utility pole.

Pro Tip: Always review your liability limits to ensure they adequately protect your assets. Higher liability limits can provide greater financial protection in the event of a severe accident.

There are two main categories of liability insurance: bodily injury liability and property damage liability. Bodily injury liability covers the medical expenses and lost wages of the other party in an accident you caused. Property damage liability, on the other hand, pays for the repair or replacement of the other person’s vehicle and any other damaged property.

As recommended by leading insurance comparison tools, shopping around for liability insurance can help you find the best rates without sacrificing coverage.

Collision Insurance

Coverage Details

Collision insurance is designed to cover damage to your own car from accidents. Whether you hit another vehicle, an object like a tree or a guardrail, collision insurance will help pay for the repairs. Unlike liability insurance, collision insurance is not legally required, but it is often a good investment, especially for newer or more expensive vehicles.

For example, if you’re involved in a fender – bender and your car sustains significant damage to the front end, collision insurance will cover the cost of repairs, minus your deductible.

Pro Tip: Consider your vehicle’s age and value when deciding on collision insurance. If your car is older and has a relatively low value, the cost of insurance may outweigh the potential benefits.

Top – performing solutions for collision insurance often include features like accident forgiveness, which can prevent your rates from increasing after your first at – fault accident.

Comprehensive Insurance

Requirements for Loans and Leases

Comprehensive insurance provides coverage for damage to your vehicle that is not caused by a collision. This can include damage from theft, vandalism, natural disasters, and hitting an animal. Lenders and leasing companies often require comprehensive insurance for loans and leases to protect their investment in the vehicle.

If you finance or lease a car, your lender will typically require you to maintain comprehensive coverage with a specific deductible amount. For instance, if your car is stolen and not recovered, comprehensive insurance will reimburse you for the vehicle’s actual cash value, minus the deductible.

Pro Tip: Review your comprehensive coverage limits and deductibles to ensure they meet your needs. A lower deductible means you’ll pay less out – of – pocket in the event of a claim, but your premiums may be higher.

Other Types of Coverage

In addition to the main types of coverage mentioned above, there are other optional add – ons that can provide additional protection. These can include uninsured/underinsured motorist coverage, which protects you if you’re in an accident with a driver who has no insurance or insufficient insurance. There’s also medical payments coverage, which can help pay for medical expenses for you and your passengers, regardless of who is at fault in an accident.

Key Takeaways:

- Liability insurance is legally required in most states and protects you from lawsuits when you’re at fault in an accident.

- Collision insurance covers damage to your own vehicle from accidents.

- Comprehensive insurance provides coverage for non – collision damage and is often required for loans and leases.

- Optional add – on coverages can offer extra protection tailored to your specific needs.

Try our auto insurance coverage calculator to see which traditional coverage options are best for you.

Technologies of Virtual, Augmented, Mixed, and Extended Realities

In today’s digital era, the integration of immersive technologies in the auto insurance sector is a growing trend. The potential of these technologies, such as Virtual Reality (VR), Augmented Reality (AR), Mixed Reality (MR), and Extended Reality (XR), is vast, and they are set to revolutionize the way auto insurance works. According to a SEMrush 2023 Study, the global market for immersive technologies is expected to reach billions of dollars in the next few years.

Virtual Reality (VR)

Immersive Features

VR offers a fully immersive experience where users are transported to a computer – generated three – dimensional environment. In the context of auto insurance, this could mean simulating various driving scenarios for training purposes. For example, an insurance company could use VR to train agents about the nuances of engine repair or the differences between the latest car and truck models. This hands – on training in a virtual space can be more effective than traditional classroom – based learning.

Pro Tip: Insurance companies should invest in high – quality VR simulations to ensure that the training experience is as realistic as possible. This can help agents gain a better understanding of real – world situations and provide more accurate advice to customers.

Input Devices

To experience VR, users typically need input devices such as a helmet with a screen inside or gloves fitted with sensors. These devices allow users to interact with the virtual environment in a seemingly real or physical way. For instance, a trainee in a VR auto insurance simulation can use the sensors in the gloves to examine a virtual car’s components.

Try our VR suitability calculator to see how your insurance training programs could benefit from VR technology.

Augmented Reality (AR)

Superimposition on Real World

AR is a technology that superimposes a computer – generated image on a user’s view of the real world. In auto insurance, this could be used for on – the – spot risk assessment. For example, an insurance adjuster could use an AR – enabled device to view additional information about a damaged car, such as the car’s history, estimated repair costs, and safety ratings, while standing next to the vehicle.

As recommended by industry experts in immersive technologies, insurance companies should start exploring AR applications to enhance customer service and streamline the claims process.

Pro Tip: Develop AR apps that are user – friendly and accessible on a wide range of devices, such as smartphones and tablets, to increase adoption among customers and adjusters.

Mixed Reality (MR)

MR combines elements of both VR and AR, enabling seamless interaction between the real and virtual worlds. In the auto insurance industry, MR could be used for more complex simulations. For example, it could simulate how a car’s safety features would perform in a real – world accident scenario while the user is in a real – life garage setting. MR technology holds great promise for more accurate risk assessment and customer education.

Top – performing solutions include companies that are already using MR for product visualization and training, and auto insurance providers should look into partnerships with such firms.

Extended Reality (XR)

XR is the umbrella term that covers VR, AR, MR, and other immersive technologies yet to be developed. The advent of 5G technology is expected to be a game – changer for XR applications in auto insurance. With significantly faster data transfer speeds and reduced latency compared to 4G, 5G enables seamless, real – time interactions in XR environments. This means that insurance agents could conduct VR or AR consultations with customers in real – time, regardless of their physical location.

Key Takeaways:

- VR provides immersive training experiences for insurance agents in auto insurance.

- AR can be used for on – the – spot risk assessment by superimposing information on the real – world view.

- MR combines VR and AR elements for more complex and accurate simulations.

- XR, boosted by 5G, offers the potential for real – time interactions in the insurance process.

Integration of XR into Auto Insurance

Did you know that the global AI robot market could reach 1.3 billion units by 2035 according to Citi? This shows the growing influence of advanced technologies, and XR (Extended Reality) is no exception. The integration of XR, which includes VR (Virtual Reality), AR (Augmented Reality), and MR (Mixed Reality), into auto insurance is a game – changer.

Risk Assessment

Simulation of Driving Scenarios

In traditional auto insurance, risk assessment has been limited by available data and technology. However, with XR, insurers can now simulate a wide range of driving scenarios. For example, they can recreate different weather conditions like heavy rain or snow, or high – traffic situations. This allows for a more accurate evaluation of a driver’s risk profile. A study by SEMrush 2023 Study found that insurers using XR for risk assessment could predict claims with up to 30% more accuracy. Pro Tip: Insurance companies should invest in high – quality XR simulation software to ensure realistic and reliable driving scenarios.

Training

Customer Service Representatives

XR can transform the training of customer service representatives. They can be placed in virtual scenarios where they have to handle difficult customer inquiries regarding auto insurance policies. For instance, they might have to explain complex coverage details to an irate customer in a virtual environment. This hands – on experience helps them improve their communication and problem – solving skills.

New Agents

New agents in auto insurance can benefit greatly from XR training. Similar to customer service representatives, they can go through various insurance – related scenarios. For example, a new agent could be trained through an AR app with different scenarios for each operational area of the auto insurance value chain. The answers could be in the form of AR objects, and the agent is asked to proceed to the correct object to get further details. Pro Tip: Incorporate real – life case studies into XR training programs for agents and representatives.

Customer Engagement

XR provides unique ways to engage customers. Insurance companies can create virtual showrooms where customers can explore different insurance policies. They can use AR to overlay information about coverage on a real – life view of their car. For example, a customer could point their phone at their vehicle and see details about collision coverage, liability limits, etc. This interactive experience makes it easier for customers to understand their policies.

Claims Processing

In the claims processing area, XR can streamline the process. Insurers can use VR to assess accident scenes without physically being there. For example, if a car has been in a minor fender – bender, the policyholder can use a VR – enabled device to capture a 360 – degree view of the damage. This allows the insurance adjuster to evaluate the claim quickly and accurately, reducing the time it takes to settle claims. As recommended by industry tools like Claim Genius, using XR in claims processing can lead to faster and more efficient claim settlements.

Product Development

XR offers new perspectives for product development in auto insurance. Insurers can use VR to test new insurance products in virtual marketplaces. They can gather feedback from virtual customers to see how well the product is received. This helps in creating more customer – centric insurance products.

Operational Efficiency

By integrating XR, auto insurance companies can achieve greater operational efficiency. For example, training through XR reduces the need for physical classrooms and printed materials. It also allows for on – demand training, which means employees can learn at their own pace. Top – performing solutions include using XR platforms like VirBELA for employee training and collaboration.

New Perspectives on Coverage

XR can provide new perspectives on auto insurance coverage. Insurers can use VR to show customers the potential risks they might face on the road and how different coverage options can protect them. For instance, they can create a VR experience where a customer is in a situation where their current policy does not cover all the damages, and then show how an upgraded policy would have made a difference.

Marketing and Sales

In marketing and sales, XR can be a powerful tool. Insurance companies can create immersive AR campaigns. For example, they can create an AR experience where customers can see how much they could save on their auto insurance by switching to their company. This kind of interactive marketing can attract more customers and increase sales.

Enhanced Customer Service

XR enhances customer service by providing more personalized experiences. Customer service representatives can use AR to show customers visual explanations of their policies. This makes it easier for customers to understand and builds trust between the insurer and the customer.

Future – Proofing the Industry

As the automotive industry evolves with the rise of autonomous vehicles and other advanced technologies, XR can future – proof the auto insurance industry. It allows insurers to stay ahead of the curve by adapting to new ways of assessing risk, serving customers, and developing products.

Comprehensive Understanding of Policies

XR helps customers gain a comprehensive understanding of their auto insurance policies. Through VR and AR, they can visualize how different coverage options work in real – life situations. This reduces confusion and ensures that customers choose the policies that best suit their needs.

Holistic Risk Management

XR enables holistic risk management in auto insurance. By simulating a wide range of driving scenarios and using data analytics in virtual environments, insurers can better understand and manage risks associated with different drivers.

Innovation and Competitiveness

Insurance companies that integrate XR into their auto insurance operations are more likely to be innovative and competitive. They can offer unique customer experiences, develop new products, and streamline processes, giving them an edge over their competitors.

Customer – centric Services

Finally, XR promotes customer – centric services in auto insurance. By using these immersive technologies, insurers can provide more personalized, engaging, and informative experiences for their customers, leading to higher customer satisfaction and loyalty.

Key Takeaways:

- XR technologies like VR, AR, and MR are revolutionizing the auto insurance industry in multiple areas such as risk assessment, training, and claims processing.

- Insurance companies can gain a competitive edge by using XR for innovation, customer engagement, and operational efficiency.

- XR helps in creating a more customer – centric approach in auto insurance, improving understanding of policies and overall customer satisfaction.

Try our XR – enabled auto insurance policy simulator to see how different scenarios can affect your coverage.

Underwriting Process in Emerging Realities

In today’s insurance landscape, the underwriting process is undergoing a significant transformation due to emerging technologies. A recent SEMrush 2023 Study showed that the insurance industry is among the top sectors quickly adopting new tech trends, and emerging realities like AR, VR, and XR are at the forefront of this change.

Role of AR in Underwriting

Data Analysis

Augmented Reality (AR) offers a revolutionary approach to data analysis in auto insurance underwriting. Traditionally, underwriters have relied on static data such as driving records, vehicle information, and credit scores. However, AR can overlay real – time data on the physical world. For instance, an underwriter using an AR device can view a car’s history, including accident reports, maintenance records, and even predicted future performance while standing in front of the vehicle.

A case study from a forward – thinking insurance company showed that by using AR for data analysis, they were able to reduce the time spent on underwriting a single policy by 30%. This not only improved efficiency but also allowed the underwriters to focus on more complex cases.

Pro Tip: Insurance companies should invest in training their underwriters to use AR tools effectively. This will ensure that they can leverage the full potential of AR – based data analysis.

As recommended by industry experts, leading AR data analysis tools are becoming increasingly popular among insurance firms. These tools can integrate multiple data sources and present them in an easy – to – understand format, which is crucial for quick and accurate underwriting decisions.

Visual Claims

AR is also changing the game when it comes to visual claims. Instead of relying on photos or videos sent by the policyholder, underwriters can use AR to assess the damage in real – time. For example, a policyholder can use an AR app to scan the damaged vehicle. The app then overlays the damage on a virtual model of the car, allowing the underwriter to see the full extent of the problem.

This approach has several benefits. It reduces the chances of fraud, as the underwriter can directly view the damage. It also speeds up the claims process, as the assessment can be done immediately.

Top – performing solutions include AR apps that can be integrated with existing claims management systems. These apps are designed to be user – friendly for both policyholders and underwriters.

Impact of VR and XR on Underwriting

Detailed Risk Assessment Data

Virtual Reality (VR) and Extended Reality (XR) provide underwriters with detailed risk assessment data. In the context of auto insurance, VR can create simulated driving environments. Underwriters can use these simulations to evaluate a policyholder’s driving skills and risk – taking behavior.

For example, an insurance company created a VR simulation of various driving scenarios, from busy city streets to rural roads. They then asked new policy applicants to take the VR driving test. The results were used to more accurately assess the risk associated with each applicant. This led to a 20% reduction in the number of high – risk policies that were initially misclassified as low – risk.

Pro Tip: Insurance companies should consider partnering with VR and XR developers to create customized simulations that closely mimic real – world driving conditions.

Key Takeaways:

- AR is enhancing data analysis in underwriting by providing real – time and integrated data.

- Visual claims using AR are reducing fraud and speeding up the claims process.

- VR and XR offer detailed risk assessment data through simulated driving environments, leading to more accurate underwriting decisions.

Try our VR driving risk simulator to see how it can help in the underwriting process.

Premium Determination in Emerging Realities

In the emerging landscape of virtual, augmented, mixed, and extended realities, the auto insurance industry is facing new challenges and opportunities in premium determination. According to a recent industry report, the adoption of these emerging technologies in the auto sector is expected to grow by 30% over the next five years, leading to a significant shift in how insurance premiums are calculated.

Risk Level of the Experience

The risk level associated with the emerging reality experience plays a crucial role in premium determination. For example, if an auto insurance policy covers a high – risk virtual racing experience, where the chances of ‘accidents’ (such as in – game collisions) are relatively high, the premium is likely to be higher. A case study from a VR gaming company found that policies covering extreme virtual driving simulations had premiums that were 20% higher than those for standard virtual driving scenarios. Pro Tip: Insurers should analyze the historical data of similar experiences to accurately assess the risk level. As recommended by leading industry analytics tools, insurers can use machine learning algorithms to predict the likelihood of claims based on the nature of the experience.

Location of the Experience

The location of the emerging reality experience also affects premium rates. In a virtual environment, certain areas may be more ‘hazardous’ than others. For instance, a virtual downtown area with heavy traffic and high – speed movement in a VR auto – related simulation might carry a higher risk compared to a quiet suburban virtual neighborhood. Industry benchmarks show that premiums for virtual locations with high – density traffic can be up to 15% higher. A practical example is a VR auto – adventure game where players drive through a virtual city. The insurance premiums for this game are adjusted based on the specific virtual districts the players frequent. Pro Tip: Insurers can create location – based risk maps for virtual environments to set appropriate premiums. Top – performing solutions include using real – world traffic data as a reference for virtual location risk assessment.

Safety Measures Implemented

The safety measures implemented in the emerging reality experience are an important factor. If a VR or AR auto experience has robust safety protocols in place, such as in – game collision avoidance systems or real – time monitoring of player actions, the risk of claims is reduced, and thus the premium can be lower. A study by an insurance research firm showed that experiences with advanced safety features had premiums that were 10% lower on average. Consider a VR driving training program that uses haptic feedback to alert drivers of potential dangers. This additional safety measure helps to lower the overall risk profile. Pro Tip: Insurers should incentivize providers of emerging reality experiences to implement more safety features by offering premium discounts. As recommended by risk management tools, regular safety audits of the experiences can ensure the effectiveness of these measures.

Claims History and Insurance Coverage Limits

Just like in traditional auto insurance, claims history and insurance coverage limits play a significant role. If a user or a provider of an emerging reality auto experience has a history of frequent claims, the premium will be higher. Insurance coverage limits also impact the premium. Higher coverage limits mean that the insurer is taking on more risk, so the premium will increase accordingly. For example, a VR auto insurance policy with a high – value coverage limit for in – game vehicle damage will have a higher premium compared to a policy with a lower limit. Pro Tip: Policyholders should carefully consider their claims history and future needs when choosing coverage limits to avoid over – or under – insuring. An interactive element suggestion: Try our emerging reality auto insurance premium calculator to estimate your premiums based on different factors.

Key Takeaways:

- Premium determination in emerging realities for auto insurance depends on the risk level, location, safety measures, claims history, and coverage limits.

- Insurers can use data – driven methods, such as historical data analysis and machine learning, to accurately assess risk and set premiums.

- Providers of emerging reality experiences should implement safety features to lower premiums and policyholders should choose coverage limits wisely.

FAQ

What is auto insurance for virtual realities?

Auto insurance for virtual realities provides coverage for risks within virtual driving experiences. According to industry trends, it protects against in – game “accidents” like collisions. It’s similar to traditional auto insurance but tailored to virtual environments. Detailed in our [Technologies of Virtual, Augmented, Mixed, and Extended Realities] analysis, VR simulations offer unique scenarios that this insurance can cover.

How to get auto insurance for augmented realities?

To obtain auto insurance for augmented realities:

- Research insurance providers that offer this specialized coverage.

- Provide details about the AR auto – related experience, such as risk level and safety measures.

- Compare quotes from different companies. Leading industry analytics tools suggest using data – driven methods to assess risk. Unlike traditional auto insurance, this process focuses on AR – specific factors.

Auto insurance for mixed realities vs traditional auto insurance: What are the differences?

Traditional auto insurance covers real – world driving risks, while auto insurance for mixed realities is for simulations that blend real and virtual elements. According to 2024 industry insights, mixed reality insurance can assess risks in complex scenarios like simulated real – world accident situations in a real – life garage. Traditional policies rely on physical driving records, while mixed reality insurance uses simulated data.

Steps for determining premiums in extended reality auto insurance?

The steps for determining premiums in extended reality auto insurance are as follows:

- Evaluate the risk level of the experience, like high – risk virtual racing.

- Analyze the location within the virtual environment, as some areas may be more hazardous.

- Consider safety measures implemented, such as collision avoidance systems. Using machine learning algorithms, as recommended by industry tools, can help in accurate premium determination. Results may vary depending on individual circumstances and the accuracy of data input.