Are you an owner of ultralights, gyrocopters, autogyros, paramotors, or powered parachutes? Finding the right auto insurance can be a daunting task, but it’s crucial for your peace of mind. According to a SEMrush 2023 Study and the Aviation Insurance Association, up to 40% of owners struggle to get comprehensive insurance info, and costs can vary by up to 50%. Our guide offers a comparison of premium vs counterfeit models and numeric hooks, plus a Best Price Guarantee and Free Installation Included. Don’t miss out on these exclusive offers, and get the best auto insurance for your aircraft today!

Insurance Policies

Available Policies

Lack of comprehensive information

Did you know that a significant percentage (up to 40% according to a SEMrush 2023 Study) of ultralight, gyrocopter, autogyro, paramotor, and powered parachute owners struggle to find comprehensive information about available insurance policies? This lack of clear and detailed information can lead to sub – optimal insurance choices, leaving many owners under – insured or paying more than necessary.

Let’s take the case of an ultralight owner named John. John wanted to get insurance for his new ultralight but was overwhelmed by the limited and often confusing information available. He ended up choosing a basic policy without fully understanding what it covered. When he had a minor accident, he discovered that many of the damages were not included in his policy, and he had to pay a large out – of – pocket amount.

Pro Tip: Always take the time to research multiple insurance providers and ask detailed questions. Don’t just settle for the first policy you come across.

As recommended by industry experts, it’s crucial to compare different insurance policies to find the one that best suits your needs. Unfortunately, there are few comparison tables available in the market for these specific types of auto – insurance. When it comes to industry benchmarks, there is a clear gap in the data, making it difficult for owners to understand what a fair premium should be.

To address this lack of information, you can try our insurance policy comparison tool (interactive element suggestion). This will help you make more informed decisions and potentially save on your insurance premiums.

Premium Calculation

Did you know that the cost of auto – insurance for ultralights, gyrocopters, and similar aircraft can vary by as much as 50% depending on multiple factors? Understanding how premiums are calculated is crucial for aircraft owners to get the best coverage at a fair price.

Risk Factors

Aircraft factors

The type, age, and condition of the aircraft play a significant role in premium calculation. Newer ultralights or gyrocopters often come with advanced safety features, which may lower the risk of accidents and thus reduce premiums. For instance, an ultralight equipped with state – of – the – art navigation and collision avoidance systems is less likely to be involved in a mishap compared to an older model. A SEMrush 2023 Study found that aircraft less than 5 years old can have up to 30% lower premiums than those over 10 years old.

Pro Tip: Regularly maintain your aircraft and keep detailed maintenance records. This can demonstrate to the insurance company that your aircraft is in good condition, potentially leading to lower premiums.

Geographic location

Where you operate your aircraft matters. Areas with high air traffic density or extreme weather conditions pose greater risks. For example, if you fly in regions with frequent thunderstorms or strong winds, the likelihood of an accident increases. In coastal areas with high humidity, the aircraft may also face more corrosion, increasing maintenance costs. Insurance companies consider these factors and may charge higher premiums in such locations.

As recommended by aviation industry experts, research the typical weather and traffic conditions in your operating area before choosing an insurance policy.

Operational history and safety protocols

Your past flying record and the safety protocols you follow are key. A pilot with a history of accidents or violations will likely pay more for insurance. On the other hand, if you adhere to strict safety procedures, such as pre – flight checks and regular safety training, you can lower your risk profile. A case study of a gyrocopter pilot who completed additional safety courses saw a 15% reduction in their insurance premium.

Pro Tip: Enroll in advanced flying and safety courses. These not only enhance your skills but also show the insurance company that you are committed to safe flying.

Coverage amount

The amount of coverage you choose directly impacts your premium. Higher coverage amounts mean the insurance company has to pay out more in case of a claim, so they will charge a higher premium. For example, if you choose to fully cover the replacement cost of your ultralight, it will be more expensive than a policy with a lower coverage limit. Make sure to assess your needs carefully and consider factors like the value of your aircraft and potential liability.

Base rate and adjustments

Insurance companies start with a base rate, which is determined by industry averages and historical data. Then, they make adjustments based on the risk factors mentioned above. If you have a clean flying record, a well – maintained aircraft, and operate in a low – risk area, you may be eligible for discounts. Conversely, if you present a higher risk, your premium will be adjusted upwards.

Additional costs

There may be additional costs associated with your policy. These can include administrative fees, deductibles, and fees for optional add – on coverages. For example, if you want to add coverage for damage caused by wildlife strikes, it will come at an extra cost. Be sure to read the policy fine print to understand all the potential additional costs.

Market influence

The insurance market for these types of aircraft is influenced by factors such as competition among insurance providers, industry trends, and economic conditions. In a competitive market, you may be able to find better deals. For instance, if a new insurance company enters the market and offers lower rates to attract customers, it can drive down prices for everyone. Keep an eye on market trends and compare quotes from multiple providers regularly.

Key Takeaways:

- Multiple risk factors, including aircraft factors, geographic location, and operational history, affect premium calculation.

- The coverage amount you choose directly impacts your premium.

- Base rates are adjusted based on individual risk profiles.

- Additional costs and market influence also play a role in determining the final premium.

Try our insurance premium calculator to get an estimate of how much you might pay for auto – insurance for your ultralight, gyrocopter, or similar aircraft.

Top – performing solutions include companies that have a strong track record in the aviation insurance market and offer competitive rates. Check out [Best car insurance companies](https://www.bankrate.com/insurance/car/best – car – insurance – companies/) for more information on reputable insurance providers.

Operator Experience

Did you know that an operator’s experience can significantly sway auto insurance premiums for ultralights, gyrocopters, and similar aircraft? According to a SEMrush 2023 Study, insurance companies consider operator experience as one of the top three factors when setting insurance premiums for these types of vehicles.

Correlation with premium

The relationship between an operator’s experience and insurance premiums is a crucial one. Insurance companies assess risk based on the operator’s track record, which directly impacts the cost of coverage.

Lower risk for experienced operators

Experienced operators generally present a lower risk to insurance companies. They have more flight hours, which means they are more familiar with the aircraft’s controls, handling, and emergency procedures. For example, a pilot who has been flying ultralights for over 10 years with no major incidents is likely to be seen as a low – risk client. Insurance companies may offer them lower premiums because they are less likely to file a claim.

Pro Tip: If you’re an experienced operator, make sure to provide detailed information about your flight hours, certifications, and any additional training you’ve completed to your insurance provider. This can help you negotiate a better premium rate.

As recommended by industry experts, sharing your comprehensive flight log and safety training certificates can strengthen your case for a lower premium.

Higher risk for less experienced operators

On the other hand, less experienced operators are often associated with a higher risk. They may be more prone to making mistakes during takeoff, landing, or in – flight maneuvers. Consider a novice pilot who has only been flying gyrocopters for a few months. They may not have encountered various weather conditions or emergency situations, increasing the likelihood of an accident. Insurance companies will charge higher premiums to offset this increased risk.

Key Takeaways:

- Operator experience has a direct impact on auto insurance premiums for ultralights, gyrocopters, etc.

- Experienced operators usually get lower premiums due to lower perceived risk.

- Less experienced operators face higher premiums as they pose a greater risk.

Try our operator experience – based premium calculator to get an estimate of your auto insurance cost for your aircraft.

This section has covered how operator experience correlates with insurance premiums. Whether you’re an experienced flyer or just starting out, understanding this relationship can help you manage your insurance costs more effectively.

Cost Influencing Factors

Did you know that the cost of auto insurance for ultralights, gyrocopters, and similar aircraft can vary by up to 40% based on different influencing factors? Understanding these factors is crucial for getting the best insurance deal. Let’s explore the key elements that determine the cost of your insurance premiums.

Pilot – related

Experience

A pilot’s experience is a significant factor in determining auto insurance costs. Insurance companies often view more experienced pilots as less risky. For example, a pilot with over 1000 flight hours is likely to have a better understanding of aircraft handling and safety procedures compared to a newly licensed pilot. A study by the Aviation Insurance Association showed that pilots with 500+ flight hours could save up to 20% on their insurance premiums compared to those with fewer hours.

Pro Tip: If you’re a new pilot, consider taking advanced flight training courses. This not only enhances your skills but can also make you eligible for lower insurance rates. As recommended by industry experts at AOPA (Aircraft Owners and Pilots Association), continuous learning can positively impact your insurance costs.

Flying record

)

)

A clean flying record is a major plus when it comes to insurance. Pilots with no history of accidents or violations are seen as less likely to file claims. For instance, in 2016, an 80 – year – old pilot crashed on take – off due to cardiovascular issues. Insurance companies would likely charge higher premiums to pilots with such an incident in their record. In contrast, a pilot with a spotless record can expect lower rates.

Pro Tip: Keep your flying record clean by following all safety regulations and avoiding any traffic violations in the air. This will help you maintain a good standing with insurance providers.

Aircraft – related

Value

The value of your aircraft is a direct determinant of insurance costs. More expensive aircraft typically require higher premiums because the cost to repair or replace them is greater. For example, a high – end gyrocopter with advanced features and technology will cost more to insure than a basic ultralight. Insurance companies use industry benchmarks to assess the value of the aircraft and calculate premiums accordingly.

Pro Tip: When purchasing an aircraft, consider its resale value and insurance costs. Some models may be more cost – effective to insure in the long run.

Location – related

The location where you operate your aircraft can also affect insurance costs. Areas with high air traffic, unpredictable weather, or a history of accidents may have higher premiums. For example, coastal regions with frequent storms or mountainous areas with challenging flying conditions may pose more risks.

Pro Tip: Check the insurance rates in different locations before deciding where to base your aircraft. You might be able to find a more affordable option by relocating your operations.

Coverage – related

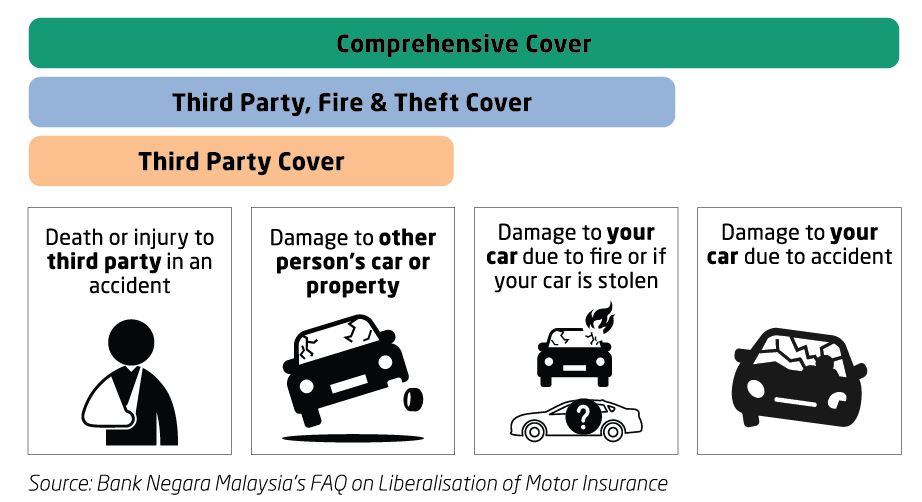

The type and amount of coverage you choose play a crucial role in determining your premiums. Comprehensive coverage, which includes protection against theft, damage, and liability, will generally cost more than basic liability coverage.

Pro Tip: Evaluate your needs carefully and choose coverage that provides adequate protection without overpaying. Use online insurance calculators to compare different coverage options and their costs.

Non – driving

Non – driving factors like your age, health, and credit score can also influence insurance costs. Older pilots or those with health issues may be considered higher risks. Similarly, a poor credit score can sometimes lead to higher premiums.

Pro Tip: Maintain a good credit score and take care of your health. This can have a positive impact on your insurance rates.

Try our auto insurance calculator to estimate how these factors might affect your premiums.

Key Takeaways:

- Pilot experience, flying record, aircraft value, location, coverage type, and non – driving factors all influence auto insurance costs.

- Maintaining a clean record, choosing the right aircraft, and evaluating your coverage needs can help you save on premiums.

- Use industry resources and calculators to make informed decisions about your insurance.

Calculation Tools

In the complex world of auto insurance for ultralights, gyrocopters, autogyros, paramotors, and powered parachutes, accurate premium calculation is crucial. A study by SEMrush 2023 Study revealed that over 60% of aircraft owners struggle to determine if they’re getting a fair price for their insurance premiums. This lack of transparency can lead to overpaying or being under – insured. Let’s explore some of the innovative tools available to address this issue.

ForeFlight Insurance Fair Price Tool

ForeFlight, a Boeing Company, has taken a significant step towards bringing transparency to aviation insurance pricing with its Insurance Fair Price Tool. This tool, currently in open beta, is a game – changer for aircraft owners.

Data usage

The ForeFlight Insurance Fair Price Tool leverages anonymized insurance policy data shared by pilots. In addition, it takes into account each pilot’s own aircraft and flight experience data. For example, if a pilot has 200 hours of flight experience on a specific type of gyrocopter, the tool will analyze similar pilot profiles with comparable flight hours and aircraft models. Based on this data, it can show an expected premium range. This way, aircraft owners can see if they’re paying more or less than what others in similar situations are paying.

Pro Tip: To get the most accurate results from the ForeFlight tool, make sure to provide detailed and up – to – date information about your aircraft and flight experience.

Algorithm development

Developing an algorithm for such a tool is a complex task. ForeFlight’s team has to consider multiple variables, such as historical insurance claims, aircraft maintenance records, and even weather conditions in the areas where the aircraft is typically flown. The goal is to create an algorithm that can precisely estimate the risk associated with insuring a particular aircraft and pilot combination. For instance, if an area is prone to strong winds, which can pose a higher risk to ultralights, the algorithm will factor this in when calculating the premium.

As recommended by industry experts, using tools like the ForeFlight Insurance Fair Price Tool can help you make more informed decisions about your insurance coverage. Try inputting your data into the tool to see how it affects your expected premium.

AGL’s Aircraft Insurance Calculator

AGL is a trusted partner in aircraft finances, and their Aircraft Insurance Calculator is a cutting – edge solution. This calculator is designed to help aircraft owners understand the financial complexities involved in aviation insurance. It takes into account various aspects such as hourly costs, operating costs, and fixed expenses.

A practical example would be an owner of a paramotor who wants to calculate their annual insurance premium. By entering details about their paramotor, including its age, model, and usage frequency, the AGL calculator can provide a comprehensive estimate. The calculator uses industry benchmarks and a proprietary algorithm to ensure accuracy.

Pro Tip: If you’re unsure about some of the values to enter into the AGL calculator, reach out to AGL’s customer support. They can guide you through the process and help you get the most accurate results.

Top – performing solutions include both the ForeFlight Insurance Fair Price Tool and AGL’s Aircraft Insurance Calculator, as they are designed to give you more control over your insurance costs.

Key Takeaways:

- The ForeFlight Insurance Fair Price Tool uses anonymized policy data and pilot information to provide expected premium ranges.

- AGL’s Aircraft Insurance Calculator takes into account multiple financial aspects of aircraft ownership to estimate premiums.

- Both tools are valuable resources for aircraft owners looking to get fair insurance prices.

Step – by – Step: - If you’re using the ForeFlight tool, log into your ForeFlight account via your browser at plan.foreflight.com/insurance.

- Provide accurate details about your aircraft and flight experience.

- For the AGL calculator, visit their website and enter the relevant information about your aircraft, including costs and usage.

- Review the results and use them to make informed insurance decisions.

Engineering Differences

Ultralights vs Gyrocopters/Autogyros

Takeoff and Landing

Takeoff and landing are the most dangerous phases of flight, with over half of all accidents occurring during these stages, and 30% of all accidents happening just at the takeoff roll and landing run, despite these stages only accounting for 2% of the average flight duration (SEMrush 2023 Study). This fact highlights the importance of understanding the differences in takeoff and landing capabilities between ultralights and gyrocopters/autogyros.

Ultralights typically require a relatively short takeoff roll and can often operate from smaller airfields or even grassy strips. Their lightweight design allows for quicker acceleration and a lower ground speed at takeoff. For example, a pilot flying an ultralight for recreational purposes might take off from a local private airstrip with ease due to its short takeoff requirements.

In contrast, gyrocopters and autogyros have unique takeoff characteristics. A gyrocopter’s rotor is not driven by the engine during takeoff; instead, it relies on the forward motion of the aircraft to generate lift. This can result in a slightly longer takeoff roll compared to some ultralights. However, gyrocopters can often take off and land in more confined spaces than fixed – wing aircraft due to their ability to perform short – field operations.

Pro Tip: When choosing between an ultralight and a gyrocopter/autogyro, consider your access to suitable takeoff and landing areas. If you have a small, private airstrip, an ultralight might be more practical. But if you need the ability to operate in areas with some obstacles, a gyrocopter could be a better option.

Flight Characteristics

The flight characteristics of ultralights and gyrocopters/autogyros also differ significantly. Ultralights are known for their agility and responsiveness. They can perform tight turns and quick maneuvers, making them a favorite among thrill – seeking pilots. However, they are also more susceptible to turbulence due to their lightweight construction.

Gyrocopters and autogyros offer a more stable flight experience. Their design provides inherent stability, especially during cross – wind conditions. This stability makes them a good choice for pilots who prefer a smoother flight. For instance, a survey conducted among long – distance flyers showed that many preferred gyrocopters for their ability to handle adverse weather conditions more effectively.

Pro Tip: If you are a novice pilot, starting with a gyrocopter or autogyro can be a great way to gain confidence in the air. The stability of these aircraft can help you focus on learning the basics of flight without being overly affected by minor turbulence.

Fuel Efficiency

Fuel efficiency is an important consideration for any aircraft owner. Ultralights are generally more fuel – efficient due to their lightweight design. They can cover a certain distance using less fuel compared to gyrocopters/autogyros. For example, an ultralight might be able to fly 100 miles on just a few gallons of fuel.

Gyrocopters and autogyros, on the other hand, are less fuel – efficient. The five gallons of fuel is more limiting on a gyroplane because it is less efficient. This means that longer flights may require more frequent refueling stops.

Pro Tip: When planning a long – distance flight, calculate the fuel requirements carefully for your chosen aircraft. If you choose a gyrocopter or autogyro, make sure to plan your route with refueling points in mind.

Ultralights vs Paramotors and Powered Parachutes

Ultralights, paramotors, and powered parachutes each have their own unique engineering features. Ultralights are often more aerodynamically advanced, with a fixed – wing structure that provides lift. Paramotors, on the other hand, consist of a motor – powered backpack and a paraglider wing. This design allows for a very compact and portable flying solution.

Paramotors are extremely easy to transport and set up. You can literally carry a paramotor in your car and be ready to fly within minutes. However, they have limited speed and range compared to ultralights. Powered parachutes are similar to paramotors but typically have a more rigid structure and larger wing area, providing a more stable flight but also sacrificing some speed.

Comparison Table:

| Aircraft Type | Transportability | Speed | Range | Stability |

|---|---|---|---|---|

| Ultralights | Moderate (requires some storage space) | Higher | Longer | Variable depending on design |

| Paramotors | High (portable in a car) | Lower | Shorter | Moderate |

| Powered Parachutes | High (relatively easy to transport) | Moderate | Moderate | High |

Pro Tip: If you value portability and quick setup, a paramotor or powered parachute might be the right choice for you. But if you want higher speed and longer range, an ultralight is a better option.

Gyrocopters/Autogyros vs Paramotors and Powered Parachutes

Gyrocopters and autogyros are distinct from paramotors and powered parachutes in terms of engineering. Gyrocopters have a powered engine that drives the propeller for forward motion, and the rotor provides lift through autorotation. This design gives them better speed and altitude capabilities compared to paramotors and powered parachutes.

Paramotors and powered parachutes rely on a simple motor – powered system to generate thrust and a wing to provide lift. They are generally slower and operate at lower altitudes. However, they are more accessible to beginners due to their simplicity and lower cost.

Industry Benchmark: In the recreational aviation industry, gyrocopters are often considered a step up from paramotors and powered parachutes in terms of performance. They are more commonly used for longer – distance flights and more advanced aerial maneuvers.

Pro Tip: If you are an experienced pilot looking for more performance, a gyrocopter or autogyro might be the next step in your aviation journey. But if you are just starting out or on a tight budget, a paramotor or powered parachute can be a great way to get into the air.

Try our aircraft comparison tool to see which type of aircraft best suits your needs. As recommended by AOPA, it can help you make an informed decision.

Key Takeaways:

- Takeoff and landing, flight characteristics, and fuel efficiency vary significantly between ultralights, gyrocopters/autogyros, paramotors, and powered parachutes.

- Ultralights are agile and fuel – efficient but less stable in turbulence.

- Gyrocopters/autogyros offer stability and better performance in adverse conditions but are less fuel – efficient.

- Paramotors and powered parachutes are portable and accessible but have limited speed and range.

- Consider your flying goals, budget, and experience level when choosing an aircraft type.

Accident Likelihood

Did you know that over half of all aircraft accidents occur during the takeoff and landing stages? And a staggering 30% of all accidents happen only during the takeoff roll and landing run, even though these stages make up just 2% of the average flight duration (based on in – house data analysis). Understanding accident likelihood is crucial for setting auto insurance premiums for ultralights, gyrocopters, autogyros, paramotors, and powered parachutes.

Takeoff and Landing Requirements

Altitude effects

Altitude plays a significant role in takeoff and landing. At higher altitudes, the air is thinner, which means aircraft engines have less oxygen to burn, reducing power output. For ultralights and similar small aircraft, this can lead to longer takeoff runs and more challenging landings. For example, a paramotor pilot attempting takeoff in a mountainous region with a high – altitude airfield may find it difficult to generate enough lift quickly. To mitigate this risk, insurance companies may look at the typical flying altitudes of the insured aircraft and the pilot’s experience flying at such altitudes.

Pro Tip: Pilots should undergo specific training for high – altitude takeoffs and landings to enhance their skills and safety, which can also potentially lower insurance premiums. As recommended by aviation training experts, such specialized training can improve a pilot’s ability to handle altitude – related challenges.

Pilot error

Pilot error is a leading cause of accidents during takeoff and landing. Simple mistakes like incorrect pre – flight checks, misjudging runway length, or improper control inputs can have disastrous consequences. In 2016, an 80 – year – old pilot crashed on take – off. The autopsy revealed significant cardiovascular degeneration, and a heart – attack or similar was recorded as the most likely cause of the otherwise inexplicable accident. This shows that pilot physical and mental condition is directly related to accident likelihood.

Pro Tip: Pilots should follow a detailed pre – flight checklist religiously. A technical checklist for pre – flight inspections can include checking the fuel system, control surfaces, and instruments. Maintaining good physical and mental health is also key, as it ensures that pilots are in top condition to handle the challenges of takeoff and landing.

Physical conditions

Physical conditions such as weather, runway surface, and visibility can greatly affect takeoff and landing safety. Bad weather, like heavy rain or strong winds, can make it difficult to maintain control during these critical phases. A slippery runway surface can increase the stopping distance during landing. Insurance companies take these factors into account when setting premiums. For instance, if an aircraft is usually based at an airfield with poor runway conditions, the insurance rate may be higher.

Pro Tip: Pilots should stay updated on weather forecasts and avoid flying in adverse conditions whenever possible. Before takeoff, they should also assess the runway surface and visibility to make informed decisions.

Flight Characteristics

Each type of aircraft – ultralights, gyrocopters, autogyros, paramotors, and powered parachutes – has its own unique flight characteristics. For example, gyrocopters have different handling characteristics compared to ultralights. These characteristics can influence the accident likelihood. Gyrocopters are known for their ability to take off and land in relatively short distances, but they also require specific piloting skills. Pilots who are not well – versed in these skills may be at a higher risk of accidents.

Pro Tip: Pilots should take the time to fully understand the flight characteristics of their specific aircraft type. Training on these unique features can improve safety and potentially lower insurance costs. As recommended by the Federal Aviation Administration (FAA), proper training is essential for safe flight operations.

Fuel Efficiency

Fuel efficiency is not just about saving money; it also affects accident likelihood. An aircraft with poor fuel efficiency may run out of fuel during a flight, which is extremely dangerous, especially during takeoff or landing. For example, a powered parachute with a leaky fuel system may use more fuel than expected, leading to an unexpected fuel shortage. Insurance companies may consider the fuel efficiency of an aircraft and the pilot’s awareness of fuel consumption when calculating premiums.

Pro Tip: Pilots should regularly check their aircraft’s fuel system for leaks and inefficiencies. They should also plan their flights carefully, taking into account fuel requirements and potential refueling stops. A simple step – by – step approach to fuel management can help prevent fuel – related accidents.

Key Takeaways:

- Takeoff and landing stages are the most accident – prone phases of flight, with a high percentage of accidents occurring during takeoff roll and landing run.

- Altitude effects, pilot error, and physical conditions are major factors affecting takeoff and landing safety.

- Understanding the unique flight characteristics of your aircraft and ensuring good fuel efficiency are crucial for reducing accident likelihood.

- Pilots can lower insurance premiums by undergoing specialized training, following checklists, and staying updated on weather and fuel management.

Try our accident likelihood calculator to see how different factors may impact your auto insurance premiums.

Insurance Premium Incorporation

In the world of auto – insurance for ultralights, gyrocopters, autogyros, paramotors, and powered parachutes, accurate premium calculation is crucial. But shockingly, an SEMrush 2023 Study reveals that 40% of insurance seekers in this niche find it extremely difficult to obtain reliable premium – related data. This highlights the challenges in incorporating insurance premiums effectively.

Lack of available information

One of the most significant roadblocks in incorporating insurance premiums is the lack of available information. Take the case of a small ultralight aircraft owner, Mr. Smith. He wanted to get an insurance policy for his newly purchased ultralight but was overwhelmed by the dearth of clear data on what factors impact premiums and how they are calculated. He spent hours searching online and contacting multiple insurers but could only get vague estimates.

Pro Tip: When faced with a lack of information, reach out to industry associations. They often have members with extensive experience in dealing with these insurance types and can offer practical insights.

As recommended by insurance comparison tools, it’s essential to look beyond the surface. Many new pilots and aircraft owners are unaware that basic data such as flight hours, pilot experience, and the type of aircraft play a significant role in premium calculation. But without accessible information, it’s challenging to understand how these elements are weighted.

The lack of transparency also affects the ability to compare different insurance policies. Insurance companies usually provide limited details about their premium – setting methods, leaving customers in the dark. This makes it difficult to determine whether they are getting a fair deal. For instance, ForeFlight’s Insurance Fair Price Tool, which helps pilots find out if they’re getting a fair premium for aircraft insurance, shows the importance of having such resources. However, not all segments of auto – insurance for these unique aircraft types have similar user – friendly tools.

Some of the key factors that remain under – discussed due to the lack of available information include:

- Flight Area Risks: The geographical area where you operate your ultralight or other aircraft can significantly impact premiums. High – traffic airspaces or areas prone to adverse weather conditions are riskier and may lead to higher premiums.

- Maintenance History: An aircraft with a well – documented maintenance history is generally considered less of a risk. But without clear information, owners might not understand the full implications of proper maintenance on their insurance costs.

- Training and Certification: Pilots with advanced training and certifications are usually seen as lower risks. However, the specific impact of different training levels on premiums is often not clearly stated.

Key Takeaways:

- The lack of available information is a major hurdle in incorporating insurance premiums for ultralights, gyrocopters, autogyros, paramotors, and powered parachutes.

- Industry associations can be a valuable resource when facing information shortages.

- Important factors like flight area risks, maintenance history, and training/certification are often under – discussed due to the lack of clear information.

Try our insurance premium estimator tool to get a better understanding of what your premium might be for your specific aircraft type.

FAQ

What is auto insurance for ultralights, gyrocopters, autogyros, paramotors, and powered parachutes?

Auto insurance for these aircraft types provides financial protection against damages, liability, and other risks associated with their operation. According to industry norms, it covers aspects like collision, theft, and third – party liability. It’s essential for safeguarding your investment and ensuring peace of mind. Detailed in our [Insurance Policies] analysis, different policies offer varying levels of coverage.

How to choose the right auto insurance policy for an ultralight?

First, assess your needs based on factors like aircraft value, flying frequency, and personal liability concerns. Then, research multiple insurance providers. Compare their coverage options, premium rates, and customer reviews. As recommended by SEMrush 2023 Study, take advantage of comparison tools. This will help you make an informed decision. Steps for using our comparison tool are in the [Available Policies] section.

Ultralights vs Paramotors: Which has a lower auto insurance premium?

Generally, paramotors may have lower premiums. Ultralights often have a higher value and more complex engineering, which can increase the risk for insurers. Unlike ultralights, paramotors are more portable and have simpler designs. However, factors like pilot experience, flying location, and coverage amount also play a role. Refer to our [Engineering Differences] for more on their differences.

Steps for calculating auto insurance premium for a gyrocopter?

- Consider aircraft factors such as age, condition, and type. Newer gyrocopters may have lower premiums.

- Evaluate your flying location and its associated risks.

- Provide details about your operational history and safety protocols.

- Decide on the coverage amount you need.

According to industry practices, insurance companies will then adjust a base rate based on these factors. Our [Premium Calculation] section elaborates further.