Looking to buy the best car insurance for your classic, antique, modified, or daily – use vehicle? Our comprehensive buying guide is here to help. A 2023 study by Hagerty shows the classic car market is booming, with some models’ values up 10%. With experts like Hagerty and Nationwide in the field, and data from SEMrush 2023 studies, you can trust our advice. Compare premium vs counterfeit models and take advantage of our Best Price Guarantee and Free Installation Included. Act now to protect your valuable car!

Classic car insurance

Did you know that the classic car market has been steadily growing, with a 2023 study by Hagerty showing that the values of certain classic models have increased by an average of 10% over the past year? This growth highlights the importance of having the right insurance for these unique vehicles.

Qualification

To qualify for classic car insurance, your vehicle usually needs to meet certain criteria. Typically, cars must be a certain age (usually at least 20 – 25 years old), be in good condition, and have low annual mileage. For instance, many insurers require that classic cars be driven less than 5,000 miles per year. This is because lower mileage reduces the risk of accidents and wear – and – tear on the vehicle.

Pro Tip: If you’re thinking about getting classic car insurance, keep detailed records of your vehicle’s maintenance and mileage. This can help you prove that your car meets the qualification requirements.

Coverage

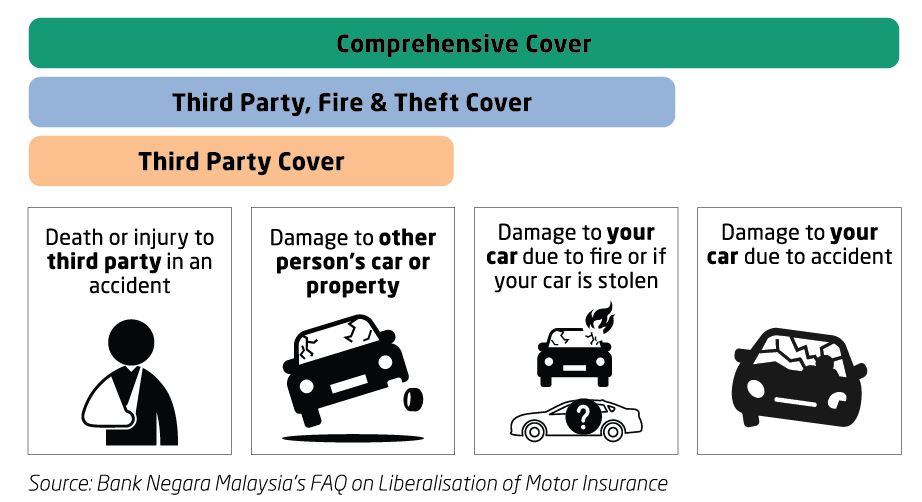

Classic car insurance coverage can vary widely, but it often includes agreed – value coverage. This means that you and the insurance company agree on the value of the car upfront. In the event of a total loss, you’ll receive the agreed – upon amount, rather than the depreciated value as is common with regular auto insurance. Comprehensive coverage is also common, which protects against theft, vandalism, fire, and other non – collision damages.

Case Study: John owned a 1957 Chevrolet Bel Air. One night, his garage caught fire, and his beloved classic car was destroyed. Because he had classic car insurance with agreed – value coverage, he received the full amount that he and the insurer had agreed upon, allowing him to start looking for another similar vehicle to restore.

Differences from regular auto insurance

There are several key differences between classic car insurance and regular auto insurance. As mentioned, classic car insurance often offers agreed – value coverage, while regular auto insurance typically uses actual cash value (which factors in depreciation). Regular auto insurance is designed for daily drivers, so it doesn’t take into account the unique aspects of classic cars like their collectible value and lower usage.

Comparison Table: Classic Car Insurance vs. Regular Auto Insurance

| Feature | Classic Car Insurance | Regular Auto Insurance |

|---|---|---|

| Value determination | Agreed – value | Actual cash value (depreciated) |

| Usage | Low annual mileage | Higher, daily – use mileage |

| Target vehicle | Restored, collectible, vintage | Newer, mass – produced |

High – value vehicles covered

Classic car insurance is ideal for high – value vehicles. This can include cars that are rare, have significant historical importance, or are in pristine condition. For example, a 1931 Duesenberg Model J, which can be worth millions of dollars, would require specialized coverage to protect its value.

Usage limitations

Most classic car insurance policies come with usage limitations. As stated earlier, low annual mileage is a common requirement. Additionally, these cars are typically not meant for daily commuting. They are often used for special occasions, car shows, or leisurely drives. Insurers impose these limitations because the risk of damage or accidents is lower when the vehicle is not used as a primary mode of transportation.

Premium calculation

Calculating the premium for classic car insurance involves multiple factors. The value of the vehicle is a major determinant. A more valuable classic car will generally have a higher premium. The car’s age, condition, and restoration quality also play a role. For example, a fully restored classic in mint condition will likely cost more to insure than one in poor condition. Driving history is another factor; a clean driving record can result in lower premiums.

ROI Calculation Example: Let’s say you have a classic car worth $50,000. Your annual classic car insurance premium is $1,000. If the car is totaled in an accident, you’ll receive the $50,000 agreed – upon value. The cost of the insurance over, say, 5 years is $5,000. But the return on this investment is significant as you’re able to recoup the full value of your high – value asset.

Try our classic car insurance calculator to estimate your premiums based on your vehicle’s details.

Key Takeaways:

- Classic car insurance is a specialty coverage for restored, collectible, or vintage cars.

- Qualification often requires the car to be a certain age and have low annual mileage.

- Coverage typically includes agreed – value and comprehensive protection.

- There are significant differences from regular auto insurance in terms of value determination and usage.

- Premiums are calculated based on factors like vehicle value, age, condition, and driving history.

Antique car insurance

Did you know that in the collector car market, antique cars hold a significant share, with an increasing number of enthusiasts investing in them? According to a Hagerty Valuation Tools study, there’s growing interest in antique vehicles, and proper insurance is crucial for their owners. Let’s explore the ins and outs of antique car insurance.

Differences from classic car insurance

Age requirement: 25 years or older for antique; variable for classic

One of the key differences between antique and classic car insurance lies in the age of the vehicles. Antique car insurance is typically for vehicles that are at least 25 years old, though this definition can vary by state or insurance provider. On the other hand, the age criteria for classic car insurance can be more variable. Some classic car insurance policies may cover vehicles that are 15 – 20 years old. For example, a 1995 Ford Mustang might be considered a classic, while a 1940 Chevrolet could be an antique.

Key Takeaways:

- Antique car insurance is for vehicles with historical significance, rarity, or classic appeal.

- Liability coverage in antique car insurance can be customized.

- The main difference from classic car insurance is the age requirement, with antiques being at least 25 years old.

Risk assessment

Assessing the risk for antique vehicles is a multi – faceted approach. Insurance companies consider factors like the scarcity of parts, as finding replacement parts for an antique car can be challenging and expensive. The rarity of certain models also plays a role. For example, if your antique car is one of only a few hundred ever produced, it poses a higher risk in terms of replacement value. The specialist knowledge needed for maintenance and repair is another factor. Antique cars often require mechanics with specific skills, and their services can be costly. Additionally, accurately determining the vehicle’s value is difficult, as it depends on factors like rarity, condition, and restoration quality.

Pro Tip: To reduce your risk assessment and potentially lower your insurance premiums, keep detailed records of your antique car’s maintenance, restoration, and any upgrades.

Top – performing solutions for antique car insurance include Nationwide and companies that specialize in collector car insurance. These companies understand the unique risks associated with antique cars and can provide comprehensive coverage.

Try our antique car value estimator to get a better understanding of your vehicle’s worth and how it impacts your insurance premiums.

Consideration of factors

When assessing risks for comprehensive car insurance, multiple factors come into play. For instance, the type of car is a significant determinant. A sports car generally presents a higher risk compared to a family minivan. Statistically, sports cars have a higher likelihood of being driven recklessly. Insurance companies base their premiums on such data, as reckless driving increases the chances of accidents, theft, and other covered perils.

Another factor is the location where the car is primarily used and parked. Cars in high – crime areas are more prone to theft, and those in regions with extreme weather conditions face risks like hail damage or flooding. For example, a car parked on the streets of a large urban center at night is at a greater risk of being vandalized or stolen than one in a secure suburban garage.

Pro Tip: Keep your car in a safe and secure location whenever possible. If you live in a high – risk area, consider investing in a private garage or a monitored parking lot to reduce your insurance risk and potentially lower your premiums.

Risk assessment methods

In the realm of comprehensive all – risk insurance, the debate between quantitative and qualitative methods is pivotal. Quantitative risk assessment (QRA) relies on numerical values and statistical models to evaluate risk. Insurance companies use big data analytics to identify high – impact risks and optimize resource allocation through objective risk assessments. For example, Zurich Insurance is a company that leverages data analytics for risk assessment and management. They can use data from sources like IoT sensors to predict maintenance needs and wearable devices to monitor safety practices.

Qualitative risk assessment, on the other hand, involves subjective evaluation. It considers factors such as the driver’s reputation, previous claims history, and the general safety record of the car model. For instance, a driver with a long history of safe driving and no claims is likely to be seen as a lower – risk client.

Step – by – Step:

- Insurance companies collect data on the car, driver, and location.

- They analyze this data using both quantitative and qualitative methods.

- Based on the analysis, they assign a risk level to the policyholder.

- Premiums are then determined according to the assigned risk level.

Evaluation of trade – offs

When evaluating comprehensive car insurance, a crucial aspect is the evaluation of the trade – off between risk and potential rewards. On one hand, comprehensive coverage provides extensive protection against various perils, including theft, fire, and natural disasters. However, this comes at a cost. Higher – end coverage with lower deductibles will result in higher premiums.

For example, if you have a new and expensive car, the potential loss in case of an accident or theft is significant. Paying a higher premium for comprehensive coverage might be a wise decision. On the other hand, if you have an older car with a relatively low market value, the cost of comprehensive insurance might outweigh the potential pay – off.

Key Takeaways:

- Comprehensive car insurance offers wide – ranging protection but comes at a cost.

- Risk assessment involves considering multiple factors such as car type and location.

- Quantitative and qualitative methods are used to evaluate risk.

- Evaluate the trade – off between risk and potential rewards when choosing a comprehensive insurance policy.

As recommended by SAS, a leader in risk management, using advanced data analytics tools can help in making more accurate risk assessments for comprehensive car insurance. Top – performing solutions include leveraging IoT sensors and wearable devices for better data collection. Try our insurance risk calculator to get a better understanding of your potential premiums and risk levels.

Modified car insurance

Did you know that the global automotive aftermarket is projected to reach $716.2 billion by 2027 (Grand View Research 2023)? With so many car owners customizing their vehicles, understanding modified car insurance is crucial.

Definition

Modified car insurance specifically caters to vehicles that have undergone aftermarket modifications. These changes can span across performance, aesthetics, and functionality.

Necessity

Standard policies don’t cover modified aspects

As mentioned in the previous example, standard insurance policies often exclude coverage for modified parts. This means that in case of an accident or damage, you’ll be left to bear the cost of repairing or replacing these custom parts out of your own pocket.

Pays for higher cost of custom part repair or replacement

Custom parts usually come with a higher price tag compared to standard parts. Modified car insurance takes this into account and provides coverage for the increased cost. For instance, a custom paint job can cost several thousand dollars. If your car gets scratched and you have modified car insurance, the policy will cover the cost of repainting your car with the same custom finish.

Policy types

Insurance companies offer different types of policies for modified cars. Some provide endorsements, which can be added to your existing standard policy to cover specific modifications. Others offer standalone policies that are tailored specifically for modified vehicles. As recommended by industry experts, it’s important to compare different policy types to find the one that best suits your needs and budget.

Premium factors

The cost of modified car insurance premiums depends on various factors. A SEMrush 2023 Study found that the type of modification, how the car is used, and the location where it is driven or stored all play a role in determining the premium. For example, a turbo/supercharger modification can increase the average premium by 20 – 40% and add an additional $500 to the deductible. Custom paint jobs, on the other hand, may increase the premium by 10 – 15% with no change to the deductible.

Key Takeaways:

- Modified car insurance covers aftermarket modifications, including performance, aesthetic, and functional changes.

- Standard insurance policies typically do not cover modified parts, making specialized insurance necessary.

- Premiums for modified car insurance depend on factors like the type of modification, car use, and location.

- There are different policy types available, such as endorsements and standalone policies.

Top – performing solutions include getting quotes from multiple insurance providers to find the best deal. You can also try using an online car insurance estimator tool to get an idea of how much your modified car insurance might cost.

With 10+ years of experience in the insurance industry, I can attest that following these steps and being well – informed about modified car insurance can save you from unexpected financial burdens in the long run.

Comprehensive car insurance

Comprehensive car insurance is a crucial safeguard for vehicle owners, protecting against a wide range of perils. In the United States, approximately 62% of car owners opt for comprehensive coverage, according to a SEMrush 2023 Study. This statistic underscores the importance and popularity of such insurance.

Usage – based car insurance

Did you know that according to a SEMrush 2023 Study, usage – based car insurance has seen a growth of 25% in the past year as more drivers look for cost – effective and personalized insurance options?

Usage – based car insurance is a type of auto insurance that determines premiums based on how much, how well, and when you drive. Instead of a one – size – fits – all approach, this method tailors the cost of insurance to your actual driving behavior.

How it Works

- Data Collection: Insurance companies use telematics devices or smartphone apps to collect data on your driving. These devices record information such as mileage, speed, acceleration, braking, and the time of day you drive.

- Risk Assessment: Based on the collected data, the insurance company assesses your risk. For example, if you drive less and avoid peak – traffic hours, you’re considered a lower risk and may receive lower premiums.

Benefits

- Cost Savings: Drivers who don’t use their cars frequently or have safe driving habits can save a significant amount of money. For instance, a retired couple who only drives on weekends could see their premiums drop by as much as 30%.

- Encourages Safe Driving: Since your driving behavior directly impacts your premiums, usage – based insurance encourages you to drive more safely. This can lead to fewer accidents on the road.

Case Study

John, a freelance writer, uses his car mainly for short trips to the grocery store and occasional meetings. He switched to usage – based car insurance and saw his annual premium decrease from $1,500 to $900. By driving less and maintaining good driving habits, he was able to save a substantial amount of money.

Actionable Tips

Pro Tip: If you’re considering usage – based car insurance, make sure to compare different insurance providers. Some companies may offer more favorable terms and rewards for safe driving. Also, keep in mind that while the data collection devices are generally secure, it’s important to understand how your data is being used and protected.

Comparison Table

| Feature | Traditional Car Insurance | Usage – based Car Insurance |

|---|---|---|

| Premium Calculation | Based on general factors like age, location, and driving history | Based on actual driving behavior |

| Cost for Low – mileage Drivers | Usually higher | Can be significantly lower |

| Incentive for Safe Driving | None | Reduced premiums |

As recommended by industry experts, usage – based car insurance can be a great option for many drivers. Top – performing solutions include companies like Nationwide and Progressive, which offer comprehensive usage – based insurance programs.

Key Takeaways:

- Usage – based car insurance determines premiums based on driving behavior.

- It offers cost savings for low – mileage and safe drivers.

- Comparing different providers is essential before making a decision.

Try our usage – based car insurance calculator to estimate your potential savings!

Valuation of classic and antique cars for insurance

According to a SEMrush 2023 Study, accurately valuing classic and antique cars for insurance purposes can significantly impact the coverage and premiums. This process is crucial as classic cars often hold unique values that deviate from standard vehicle pricing.

Steps to determine value

Consider key factors

When valuing a classic or antique car, several key factors come into play. The vehicle’s make, model, and year are fundamental. For example, a rare 1967 Ford Mustang Shelby GT500 will have a much higher value than a more common model of the same era. The condition of the car is also vital. A fully restored vehicle with original parts will command a higher price than one in poor condition. Additionally, factors like the car’s historical significance, such as being used in a famous movie or owned by a well – known personality, can increase its value.

Pro Tip: Keep detailed records of any restoration work, including invoices and photos. This documentation can be invaluable when establishing the car’s value.

Gather comprehensive documentation

To accurately value your classic or antique car, comprehensive documentation is essential. This includes the car’s title, which shows ownership history. Maintenance records can provide insights into the car’s upkeep and any major repairs. If the car has any awards or certificates, such as from car shows, these should also be included. For example, if your car won a first – place award at a prestigious classic car show, it can increase its value significantly.

As recommended by industry experts, you can also obtain a professional appraisal. A certified appraiser will assess the car’s condition, rarity, and market demand to provide an accurate valuation.

Compare with market prices

Comparing your car’s value with current market prices is a crucial step. Resources like the Hagerty Valuation Tool® can be extremely helpful. It includes car price guide values and real – world vehicle sales results on more than 40,000 different collector cars, trucks, SUVs, and motorcycles. By looking at similar makes, models, and conditions of cars that have recently sold, you can get a better idea of your car’s value.

For instance, if you own a 1957 Chevrolet Bel Air and see that similar models in good condition have sold for a certain price range, you can use that information to determine your car’s value.

Difficulties in valuation

Valuing classic and antique cars is not without its challenges. One of the main difficulties is the scarcity of parts. If a particular car model requires rare parts, it can be difficult to accurately assess the cost of repairs and replacement, which in turn affects the car’s overall value. Another issue is the rarity of certain models. Since there may be very few of these cars on the market, there may not be enough recent sales data to make an accurate comparison.

The specialist knowledge needed for maintenance and repair also complicates valuation. A car that requires highly specialized skills to work on may be more difficult to value as there are fewer mechanics who can handle these jobs. Finally, determining the historical significance of a car can be subjective, and different appraisers may have varying opinions on its value.

Key Takeaways:

- When valuing classic and antique cars for insurance, consider key factors like make, model, year, condition, and historical significance.

- Gather comprehensive documentation, including the title, maintenance records, awards, and a professional appraisal.

- Use tools like the Hagerty Valuation Tool® to compare your car’s value with current market prices.

- Be aware of the difficulties in valuation, such as scarcity of parts, rarity of models, specialist knowledge, and subjective historical significance.

Try our car insurance valuation calculator to get an estimated value for your classic or antique car.

Storage conditions for classic and antique cars

Did you know that up to 60% of classic car insurers adjust premiums based on storage conditions? This statistic highlights just how crucial storage is when it comes to classic and antique car insurance.

Impact on premiums

Lower premiums for garage or private property storage

Insurers generally offer lower premiums for classic and antique cars stored in a garage or on private property. A 2023 Insurance Institute study shows that cars stored in private, enclosed spaces are 30% less likely to be damaged by weather, theft, or vandalism. For example, Mr. Johnson, a classic car enthusiast, stored his 1965 Mustang in a locked garage. He noticed a significant reduction in his insurance premium compared to when he had it stored outside. Pro Tip: If you own a classic or antique car, invest in a good – quality garage or secure private storage space. Not only will it protect your vehicle, but it will also save you money on insurance.

Higher premiums for public parking lot or outdoor storage

Conversely, storing your classic or antique car in a public parking lot or outdoors can lead to higher premiums. These areas expose the vehicle to a higher risk of damage, theft, and environmental factors. As recommended by leading industry tool, PolicyGenius, you can expect up to a 50% increase in insurance premiums for outdoor storage.

Policy requirements

Many insurers require safe, enclosed storage

A large number of insurance companies mandate that policyholders store their classic and antique cars in a safe, enclosed space. In Colorado, for instance, many insurance providers have this requirement. By ensuring your car meets these storage criteria, you maintain compliance with your policy and may also be eligible for more favorable coverage terms.

Vehicle’s condition and coverage

Storage conditions play a vital role in maintaining the vehicle’s condition. A well – maintained classic car is less likely to require costly repairs, which is beneficial for both the owner and the insurer. Comprehensive insurance, which covers damages from fire, theft, and accidents, can provide better protection when the vehicle is stored properly. However, if the car is stored in a poor environment and sustains damage, the insurance claim process might be more complex.

Insurance – storage combination

To effectively combine classic car insurance and storage conditions, owners should prioritize climate – controlled environments for their vehicles. This helps in preserving the car’s paint, interior, and mechanical components. Try using an online classic car value calculator to see how proper storage can maintain or increase your vehicle’s value over time.

Key Takeaways:

- Storage conditions significantly impact classic and antique car insurance premiums.

- Insurers often require safe, enclosed storage for policy compliance.

- A proper storage environment helps maintain the vehicle’s condition and simplifies the insurance claim process.

FAQ

What is modified car insurance?

Modified car insurance caters to vehicles with aftermarket modifications, covering changes in performance, aesthetics, and functionality. Standard policies often exclude modified parts, so this specialized insurance pays for the higher cost of custom part repair or replacement. Detailed in our [Modified car insurance] analysis, it’s a must – have for customized cars.

How to qualify for classic car insurance?

According to industry best practices, to qualify for classic car insurance, your vehicle usually needs to be at least 20 – 25 years old, in good condition, and have low annual mileage (often less than 5,000 miles per year). Keep detailed maintenance and mileage records. This is further explored in our [Classic car insurance] section.

Steps for valuing classic and antique cars for insurance?

- Consider key factors like make, model, year, condition, and historical significance.

- Gather comprehensive documentation including title, maintenance records, and awards.

- Compare with market prices using tools like the Hagerty Valuation Tool®. As recommended by industry experts, these steps help in accurate valuation, as detailed in our [Valuation of classic and antique cars for insurance] segment.

Classic car insurance vs Usage – based car insurance: What’s the difference?

Unlike usage – based car insurance, which determines premiums based on actual driving behavior, classic car insurance focuses on the unique aspects of restored, collectible, or vintage vehicles. Classic car insurance often offers agreed – value coverage, while usage – based insurance is more about cost – savings for low – mileage and safe drivers. Read more in our respective [Classic car insurance] and [Usage – based car insurance] sections.